Navigating the complexities of currency exchange and fluctuations can be daunting, especially in today’s globalized world. This comprehensive guide demystifies the process, from understanding fundamental concepts to implementing practical strategies for minimizing potential losses. Whether you’re an international traveler, a business owner conducting global trade, or an investor engaging in international markets, this resource equips you with the knowledge and tools to confidently manage currency exchange and fluctuations.

This guide will explore various aspects of currency exchange, including the different exchange methods, the factors influencing exchange rates, and strategies for mitigating risks. It will provide a clear understanding of how currency fluctuations impact international transactions, investments, and travel plans, offering valuable insights into effective management techniques.

Understanding Currency Exchange Basics

Currency exchange is a fundamental aspect of international trade and travel, enabling the conversion of one currency into another. This process facilitates transactions across borders and allows individuals and businesses to engage in global commerce. Understanding the mechanics of currency exchange is crucial for anyone involved in international dealings.Currency exchange involves converting one currency into another at an agreed-upon rate.

This rate is influenced by various market forces, including supply and demand, interest rates, and political stability. Fluctuations in these forces can lead to changes in exchange rates, which are important to consider for planning international transactions.

Fundamental Concepts of Currency Exchange

Currency exchange is the process of converting one currency into another. This process is necessary to facilitate international transactions, whether for trade, travel, or investments. It allows parties in different countries to conduct business with each other using a common medium of exchange. A key component is the exchange rate, which is the value of one currency relative to another.

Simplified Example of a Currency Exchange Transaction

Imagine a traveler from the United States planning a trip to Europe. They need to exchange US Dollars (USD) for Euros (EUR). The exchange rate is currently 1 USD = 0.85 EUR. If the traveler wants to exchange $100 USD, they will receive approximately 85 EUR. This example illustrates the direct relationship between the exchange rate and the amount of currency received.

Different Types of Currency Exchange Methods

Various methods are available for conducting currency exchange transactions. These methods vary in terms of fees, convenience, and accessibility.

- Bank Exchange: Banks offer currency exchange services, often with fixed exchange rates. They usually have physical branches, making them convenient for in-person transactions. However, they might charge higher fees compared to other methods.

- Online Platforms: Online platforms provide a wide range of exchange options. They frequently offer competitive exchange rates and are accessible 24/7. The convenience of online platforms often comes with fees and potential security risks.

- Travel Money: Companies specializing in travel money provide pre-paid cards or cash that can be used internationally. This method is convenient for travelers, often with fixed exchange rates. Fees and exchange rates can vary, so comparing options is essential.

Comparison of Currency Exchange Methods

The table below summarizes the advantages and disadvantages of different currency exchange methods.

| Exchange Method | Pros | Cons |

|---|---|---|

| Bank Exchange | Convenience of physical locations, potentially lower fees for high-volume transactions. | Limited accessibility (opening hours), potential for higher fees compared to other methods. |

| Online Platforms | Accessibility 24/7, competitive exchange rates, potentially lower fees than banks. | Requires internet access, potential security risks, need for understanding of exchange platforms. |

| Travel Money | Convenience for international travel, often with pre-set exchange rates. | Fees and exchange rates can vary, need for understanding of the service. |

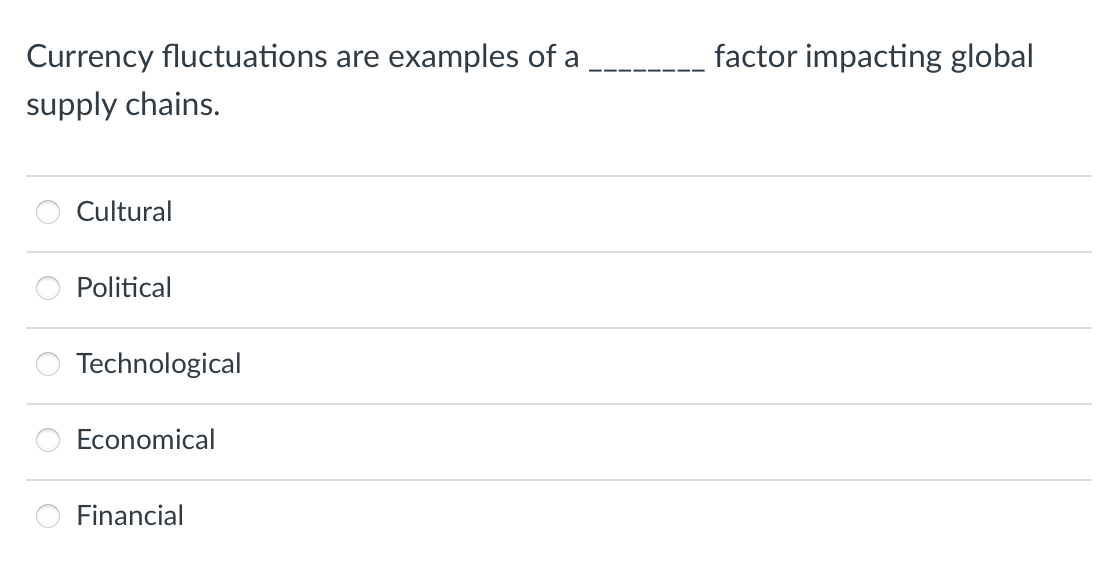

Factors Affecting Exchange Rates

Understanding the forces that drive currency fluctuations is crucial for navigating the complexities of international finance. Exchange rates are not static; they are constantly influenced by a multitude of interconnected economic factors. These factors, while often complex, are fundamentally rooted in the principles of supply and demand, impacting everything from international trade to investment strategies.A comprehensive understanding of these influencing factors allows for a more informed approach to currency management and risk mitigation.

By analyzing the dynamics behind exchange rate movements, individuals and businesses can better position themselves for success in a global marketplace.

Key Economic Factors Influencing Currency Fluctuations

Several key economic factors play a significant role in shaping currency exchange rates. These factors are interconnected and can interact in complex ways, often resulting in unpredictable fluctuations. Understanding these influences is vital for anyone involved in international trade, investment, or simply managing personal finances across borders.

- Supply and Demand: The fundamental principle of supply and demand governs currency exchange rates. A high demand for a currency relative to its supply will drive up its value, while a low demand and high supply will cause its value to depreciate. This principle is directly influenced by factors like import/export activities, investment flows, and speculation.

- Interest Rates: Interest rates set by a central bank play a crucial role in determining a currency’s attractiveness to investors. Higher interest rates generally attract foreign investment, increasing demand for the currency and driving up its value. Conversely, lower interest rates tend to decrease demand and depress the currency’s value.

- Inflation: Inflation, the rate at which prices for goods and services rise, directly impacts a currency’s purchasing power. A high inflation rate erodes the value of a currency, leading to a depreciation in its exchange rate against other currencies. Conversely, a stable or low inflation rate tends to strengthen the currency.

- Political Stability: Political stability and government policies significantly influence investor confidence. Political instability and uncertainty can create significant economic risks, discouraging investment and causing a decline in the value of the affected currency. Stable and predictable political environments, on the other hand, tend to attract investment, bolstering the currency’s value.

Correlation Between Factors and Currency Fluctuations

The interplay of these factors often leads to complex and unpredictable currency fluctuations. The table below illustrates the general correlation between these key economic factors and their impact on currency values.

| Factor | Impact on Currency Value | Example |

|---|---|---|

| Supply and Demand | High demand, low supply = appreciation; Low demand, high supply = depreciation | Increased exports from a country can increase demand for its currency. |

| Interest Rates | Higher interest rates = appreciation; Lower interest rates = depreciation | A country with high interest rates may attract more foreign investment. |

| Inflation | High inflation = depreciation; Low inflation = appreciation | High inflation erodes the purchasing power of a currency, leading to its depreciation. |

| Political Stability | Political stability = appreciation; Political instability = depreciation | Investors are less likely to invest in countries with political turmoil. |

Strategies for Minimizing Exchange Rate Losses

Minimizing potential losses from unfavorable exchange rate fluctuations is crucial for businesses engaged in international trade and investment. Understanding the factors influencing exchange rates and implementing appropriate strategies can significantly mitigate these risks. This section will detail various techniques to manage currency risk and safeguard against volatility.Effective strategies for managing currency risk involve careful planning and proactive measures.

These strategies, discussed below, aim to protect against potential losses arising from unexpected changes in exchange rates. By employing suitable hedging techniques, businesses can better forecast and control their financial exposures in international transactions.

Hedging Strategies for Currency Risk

Hedging strategies are essential tools for managing currency risk. These techniques involve creating offsetting positions in the foreign exchange market to reduce or eliminate potential losses from adverse exchange rate movements.

- Forward Contracts: Forward contracts are agreements to buy or sell a specific amount of a currency at a predetermined exchange rate on a future date. This allows businesses to lock in an exchange rate, eliminating uncertainty and potential losses due to fluctuating exchange rates. For example, a U.S. company exporting goods to the Eurozone can use a forward contract to secure a specific exchange rate for their future payment in Euros, ensuring a predictable revenue stream, regardless of how the exchange rate moves between the time of the contract and the payment date.

- Futures Contracts: Futures contracts are standardized agreements to buy or sell a specific amount of a currency at a predetermined exchange rate on a future date. Similar to forward contracts, futures contracts allow businesses to lock in an exchange rate and mitigate currency risk. The standardized nature of futures contracts makes them more liquid and readily available than forward contracts.

For example, an importer of Japanese electronics can use futures contracts to secure the exchange rate for the Yen needed to complete the transaction, protecting against potential increases in the value of the Yen compared to the USD.

- Currency Options: Currency options provide the right, but not the obligation, to buy or sell a specific amount of a currency at a predetermined exchange rate on or before a certain date. Options allow businesses to limit their exposure to adverse exchange rate movements without committing to a fixed exchange rate. For instance, a company anticipating receiving payments in British pounds can purchase put options to protect against a devaluation of the pound.

This provides a safety net, allowing the company to potentially buy pounds at a more favorable rate if the exchange rate falls.

- Currency Swaps: Currency swaps are agreements to exchange principal and interest payments in different currencies. This strategy is particularly useful for managing long-term currency exposure. For example, a company with significant obligations denominated in Euros could engage in a currency swap to convert those obligations into a different currency to mitigate their risk of currency fluctuations.

Table of Hedging Methods

This table Artikels various hedging methods, highlighting their characteristics and applicability.

| Hedging Method | Description | Characteristics | Example |

|---|---|---|---|

| Forward Contracts | Agreement to exchange currency at a future date at a predetermined rate. | Fixed exchange rate, less flexibility. | A US exporter agrees to receive Euros at a specific rate in 3 months. |

| Futures Contracts | Standardized agreements to buy or sell currency at a future date at a predetermined rate. | More liquid than forwards, standardized terms. | An importer buys futures contracts to secure the Yen exchange rate for Japanese electronics imports. |

| Currency Options | Right (but not obligation) to buy or sell currency at a predetermined rate. | Flexibility, potential for limited gains. | A company anticipating GBP payments buys put options to protect against a decline in the GBP value. |

| Currency Swaps | Exchange of principal and interest payments in different currencies. | Useful for long-term currency exposures. | A company with Euro obligations converts them to a different currency via a currency swap. |

Tools and Resources for Tracking Exchange Rates

Staying informed about fluctuating currency exchange rates is crucial for businesses and individuals alike. Proper tracking allows for proactive adjustments to transactions and mitigates potential losses. This section details various tools and resources available to monitor exchange rates effectively.Effective currency rate tracking involves using reliable tools and resources. A well-chosen tool can provide valuable insights into the current market conditions, enabling informed decisions and potential cost savings.

Understanding the strengths and limitations of different options is paramount for selecting the right fit.

Currency Converter Apps and Websites

A wide array of currency converter apps and websites offer instant exchange rate information. These tools are convenient for quick lookups and comparisons.These resources often provide real-time updates, making them valuable for individuals and businesses needing current exchange rates. However, some limitations exist, including potential inaccuracies or discrepancies in displayed rates. It’s important to compare results from multiple sources to ensure accuracy.

Furthermore, some free converters may display rates with less precision than premium or paid options. Always be mindful of these factors when relying on a currency converter.

Reputable Currency Tracking Resources

Numerous reputable resources offer more comprehensive exchange rate tracking. These platforms often provide historical data, charts, and analysis tools, which go beyond simple conversion calculations. They offer a deeper understanding of market trends and can be helpful for long-term planning and strategy development.

| Resource | Strengths | Weaknesses |

|---|---|---|

| XE.com | Known for its accurate and up-to-date exchange rates, detailed historical data, and comprehensive currency tools. | Can be slightly more complex for beginners compared to simpler converters. |

| Google Finance | Easy access via a widely used search engine, offering real-time updates and historical data. | Accuracy may vary depending on the specific currency pair and the time of access. |

| Bloomberg | Provides in-depth market analysis and historical data, useful for investors and businesses. | Requires a subscription for access to full functionality and may be expensive. |

| OANDA | Offers various currency tools and data, including detailed graphs and charts for market analysis. | Free version might have limited features compared to paid options. |

The table above presents a comparative overview of popular currency tracking resources. It highlights the pros and cons of each, aiding users in selecting the best option based on their needs and preferences. It’s important to compare resources before making a choice to ensure the desired level of accuracy and depth of analysis is met.

Accuracy and Reliability Considerations

The accuracy and reliability of currency tracking tools are essential considerations. Differences in displayed rates can occur due to varying data sources and real-time market fluctuations. It’s critical to verify information from multiple sources for reliable exchange rate information.Furthermore, the frequency of updates and the source of data influence the accuracy of the results. Users should consider these factors when choosing a tool for tracking exchange rates.

Choosing a reliable tool and double-checking information across various sources ensures users receive the most accurate and trustworthy data possible.

Planning for International Travel and Transactions

Preparing for international travel involves meticulous planning, extending beyond just booking flights and accommodations. A crucial aspect of this preparation is understanding and managing currency exchange effectively. Proper planning minimizes potential financial surprises and allows for a more enjoyable and stress-free trip. This section details pre-trip strategies for currency exchange, financial management tips during travel, and insights into using various payment methods.

Pre-Trip Currency Exchange Strategies

Effective pre-trip planning involves proactive strategies for managing currency exchange. Understanding the prevailing exchange rates and employing suitable exchange methods can significantly impact the overall cost of travel. This often involves comparing exchange rates offered by banks, credit unions, and specialized currency exchange services to find the most favorable rate.

- Comparing Exchange Rates: Research and compare exchange rates from various sources before making a decision. Banks, credit unions, and online providers typically offer different rates. For example, a bank might offer a slightly better rate than a currency exchange service, but the service might provide faster access to funds. Factor in any fees associated with each option.

- Using a Prepaid Travel Card: These cards often provide favorable exchange rates compared to using a credit or debit card directly abroad. They can also offer features such as travel insurance and ATM withdrawal limits, simplifying your travel finances.

- Exchange Before Departure: Exchanging a portion of your currency before leaving allows for easier access to local funds upon arrival. This pre-exchange can be useful for initial expenses like transportation and accommodation. Consider whether the exchange rate at your destination is more favorable to using ATMs or credit cards.

- Using a Currency Exchange Service: Specialized currency exchange services may offer competitive rates, especially for larger transactions. However, be aware of any fees or commissions charged by the service.

Managing Finances During International Travel

Effective financial management during international travel is critical for avoiding unexpected costs and maximizing your budget. Establishing a travel budget and adhering to it, combined with a plan for unexpected expenses, is crucial.

- Creating a Travel Budget: Develop a detailed budget that includes anticipated costs for accommodation, food, activities, transportation, and potential unexpected expenses. This helps you stay within your financial limits and track your spending.

- Using Cash Wisely: Utilize cash strategically, allocating it for smaller purchases and emergencies. Avoid relying solely on cash, as this can limit your options and potentially increase the risk of theft or loss.

- Utilizing ATMs: ATMs are a common way to access local currency. However, be mindful of potential ATM fees and ensure you are aware of the exchange rate applied by the ATM network.

- Having a Contingency Fund: Allocate a portion of your budget for unforeseen circumstances. This could be for unexpected medical expenses, lost luggage, or other unforeseen circumstances.

Using Credit Cards or Debit Cards Abroad

Choosing between credit cards and debit cards for international transactions requires careful consideration of the associated benefits and drawbacks. Understanding the fees and potential charges is essential.

- Advantages of Credit Cards: Credit cards often provide purchase protection and emergency assistance. Some cards may also offer travel insurance benefits. However, be mindful of potential foreign transaction fees.

- Disadvantages of Credit Cards: Foreign transaction fees and high interest rates on outstanding balances can negatively impact your travel finances if not carefully managed. Ensure you understand the terms and conditions of your credit card regarding international transactions.

- Advantages of Debit Cards: Debit cards typically do not accrue interest charges. They immediately deduct funds from your account, which can be useful for budgeting. However, debit cards might have transaction limits, and it’s essential to check the associated fees for international use.

- Disadvantages of Debit Cards: If your account balance is insufficient to cover the transaction, you might be declined, potentially leading to problems. Debit cards often have transaction limits for international transactions, which can be inconvenient.

Making Transactions in a Foreign Currency

Making transactions in a foreign currency involves careful attention to the exchange rate, fees, and payment methods. A clear understanding of the transaction process is crucial to avoiding misunderstandings and ensuring smooth financial management.

- Understanding Exchange Rates: Before making a purchase, ascertain the exchange rate being applied. If you are not sure about the rate, inquire with the vendor.

- Checking for Fees: Inquire about any fees associated with the transaction, such as foreign transaction fees, service charges, or conversion fees. Knowing these fees is critical for accurate budgeting.

- Using the Correct Payment Method: Choose the payment method that aligns with the vendor’s acceptance and your budget. If using a credit card, ensure you understand the potential fees and interest rates involved.

- Keeping Records: Maintain detailed records of all transactions in a foreign currency, including the date, amount, exchange rate, and any associated fees.

Best Practices for Currency Exchange

Effective currency exchange hinges on careful planning and adherence to best practices. Understanding the intricacies of exchange rates and the various providers available is crucial for minimizing potential losses and maximizing your returns. By employing sound strategies, you can navigate the complexities of international transactions with greater confidence.

Choosing Reputable Exchange Providers

Selecting reputable exchange providers is paramount to ensuring a smooth and advantageous transaction. These providers, often financial institutions or specialized exchange companies, maintain a history of responsible financial dealings and transparent practices. They are committed to offering competitive exchange rates and fees, safeguarding your funds, and providing clear communication throughout the process. Researching and comparing different providers is essential.

Consider their reputation, customer reviews, and financial stability.

Comparing Exchange Rates and Fees

Thorough comparison of exchange rates and fees before any transaction is vital. Different providers offer varying rates, and these rates fluctuate based on market conditions. A simple online search can reveal a range of rates. Don’t just rely on the first quote you receive. Actively seeking multiple quotes from various providers allows you to make an informed decision and identify the most favorable terms.

In addition to the exchange rate, scrutinize any associated fees, including commissions, service charges, or transaction costs. Understanding these fees is essential to calculate the overall cost of the transaction. Compare not only the displayed rate but also the total cost to determine the best option.

Using Secure Methods for Online Currency Exchange

Online currency exchange necessitates the utmost security. The use of secure methods is crucial to safeguard your personal and financial information from unauthorized access. Always use secure websites with HTTPS encryption, indicating a secure connection, to protect your data during online transactions. Be cautious of suspicious emails or links requesting sensitive information. Avoid using public Wi-Fi networks for online currency exchange.

A secure, private network is paramount for protecting your sensitive financial details.

Step-by-Step Guide to Safe Online Currency Exchange

A structured approach to online currency exchange can minimize risks and ensure a successful transaction. Follow these steps for a secure and efficient process:

- Research and Comparison: Thoroughly research different exchange providers and compare their exchange rates and fees. Consider the provider’s reputation and security measures. Consult online reviews and seek referrals.

- Verification of Website Security: Verify the website’s security by checking for the “https” prefix and a secure lock icon in the browser address bar. This indicates an encrypted connection, protecting your sensitive information.

- Data Entry Caution: Carefully enter all required information, ensuring accuracy and avoiding any errors. Double-check the details before confirming the transaction.

- Transaction Confirmation: Review the transaction details, including the exchange rate, fees, and the total amount payable. Verify the recipient’s details to ensure accuracy.

- Secure Payment Methods: Utilize secure payment methods like credit cards with robust security protocols, or trusted online payment platforms, to complete the transaction. Avoid using less secure methods like wire transfers for online exchange, as these are prone to greater risk.

- Record Keeping: Maintain records of all transactions, including the exchange rate, fees, and the date of the transaction. This is essential for future reference and tracking purposes.

Dealing with Currency Fluctuations During Investments

International investments, while offering potential for higher returns, are susceptible to fluctuations in exchange rates. Understanding how these fluctuations affect your portfolio is crucial for making informed decisions and managing risk effectively. Appreciating the interplay between currency values and investment performance is vital for success in global markets.

Impact of Currency Fluctuations on International Investments

Currency fluctuations directly impact the value of international investments when returns are repatriated. A strengthening of the investor’s home currency relative to the foreign currency in which the investment is denominated will reduce the return when converted back to the home currency. Conversely, a weakening of the home currency will increase the return. This is a key consideration for investors who need to factor in the impact of exchange rates on their overall investment returns.

For example, an investment yielding 10% in a foreign currency might translate to a lower return in the investor’s home currency if the foreign currency depreciates against the home currency during the investment period.

Examples of Currency Movement Impacts on Investment Returns

Consider an American investor purchasing shares in a Japanese company. If the Japanese Yen depreciates against the US Dollar, the investor’s return, when converted back to USD, will be reduced. Conversely, if the Yen appreciates, the return in USD will be enhanced. Historical data illustrates this impact, showing how significant exchange rate movements can dramatically alter the realized return on international investments.

For example, a 10% return in Japanese Yen might be equivalent to a 7% return in US dollars due to a weakening Yen.

Strategies for Mitigating Currency Risk

Several strategies can help mitigate currency risk in international investments. Diversification across multiple currencies is a primary strategy to reduce the impact of fluctuations in any single currency. Investing in diversified international indexes, such as the MSCI EAFE (Europe, Australia, Far East), can also provide some protection.

Use of Currency Hedging Instruments

Currency hedging instruments, such as forward contracts, futures contracts, and options, can effectively manage currency risk. These instruments allow investors to lock in an exchange rate for future transactions, thereby mitigating the potential for adverse currency movements. A forward contract, for example, obligates both parties to exchange currencies at a predetermined rate and date.

Forward contracts allow investors to fix the exchange rate, reducing the risk of adverse currency movements.

For example, an investor anticipating repatriation of funds from a foreign investment can enter into a forward contract to sell the foreign currency at a predetermined exchange rate, ensuring a known return in their home currency. Options contracts offer more flexibility, allowing investors to hedge against potential losses without being obligated to execute the transaction. Understanding the specifics of each instrument is crucial to effectively utilize them in investment portfolios.

This approach can be particularly beneficial for investors who have significant international exposure.

Practical Tips for Individuals and Businesses

Effective management of currency exchange is crucial for both individuals and businesses, particularly in today’s interconnected global market. Understanding the nuances of exchange rates and employing appropriate strategies can significantly impact financial outcomes, whether for personal travel or international trade. This section offers practical advice for navigating currency fluctuations and maximizing value.Managing currency exchange involves more than just selecting a provider; it requires proactive planning and an understanding of the tools available.

This section details essential strategies for individuals and businesses to optimize their currency exchange processes.

Strategies for Individuals

Strategies for individuals to effectively manage currency exchange include careful planning and comparison of options. Pre-trip planning, such as purchasing currency in advance or utilizing a credit card with favorable exchange rates, can minimize unexpected costs.

- Pre-trip Planning: Determine the approximate amount of foreign currency needed for the trip. Compare exchange rates offered by various banks, credit unions, and online providers before making a purchase. Consider using a credit card with a favorable exchange rate to reduce potential losses.

- Utilizing Technology: Explore online currency exchange platforms and apps. These tools often provide real-time exchange rates, allowing for informed decisions. Consider automated alerts that notify you of significant rate changes, enabling proactive adjustments to your plans.

- Avoiding Hidden Fees: Be vigilant about hidden fees associated with currency exchange services. Compare the total cost, including exchange rates and transaction fees, before choosing a provider.

Strategies for Businesses

Businesses engaged in international trade or operating across borders require more sophisticated approaches to currency exchange. Employing the right tools and understanding the nuances of international trade can help mitigate potential risks.

- Currency Forward Contracts: Businesses involved in long-term contracts or projects can use forward contracts to lock in an exchange rate, reducing uncertainty and potential losses. These contracts allow for pre-determined rates, hedging against significant fluctuations.

- Currency Hedging Strategies: Implement hedging strategies to mitigate currency risk. This may involve using options, futures, or other derivative instruments to offset potential losses from unfavorable exchange rate movements. Hedging strategies are crucial for businesses with significant international exposure.

- Currency Exchange Tools: Utilize specialized currency exchange tools, such as those offered by financial institutions, for efficient management of international transactions. These tools can provide real-time quotes, track exchange rate trends, and optimize transactions.

Currency Exchange Tools for Small Businesses

Small businesses engaged in international trade can benefit from dedicated currency exchange tools. These tools facilitate efficient and cost-effective international transactions.

- Online Platforms: Several online platforms offer comprehensive currency exchange services, providing real-time quotes and transaction processing. These tools simplify the process for businesses with limited in-house expertise.

- Dedicated Software: Specific software solutions are available that integrate with accounting systems. These solutions automate currency conversions and streamline financial reporting, particularly beneficial for businesses with frequent international transactions.

- Financial Institutions: Leverage the expertise of financial institutions to access dedicated currency exchange services. Working with experienced professionals can provide tailored solutions and potentially reduce transaction costs.

Efficient International Trade

Businesses can use currency exchange services to enhance their efficiency in international trade. This includes understanding how to manage payments and optimize transactions.

- Multi-Currency Accounts: Establish multi-currency accounts to facilitate transactions in various currencies, reducing the need for constant currency conversions and simplifying record-keeping.

- International Payment Systems: Utilize international payment systems optimized for cross-border transactions. These systems can often offer faster processing and lower fees compared to traditional methods.

- Real-Time Tracking: Track currency fluctuations in real-time to ensure timely adjustments to pricing strategies and payment terms. This proactive approach can help businesses mitigate risks and optimize profit margins.

Frequently Asked Questions (FAQ)

- How do I choose the right currency exchange service? Compare exchange rates, transaction fees, and service offerings from various providers. Consider factors such as reputation, security, and ease of use.

- What are the potential risks of using online currency exchange platforms? Research the platform’s reputation and security measures. Be wary of platforms with poor reviews or insufficient security protocols.

- How can I minimize currency exchange losses during investments? Utilize hedging strategies to mitigate potential losses associated with unfavorable exchange rate movements.

Conclusion

In conclusion, mastering currency exchange and fluctuations requires a multifaceted approach. This guide has provided a structured framework for understanding the intricacies of currency markets, highlighting the importance of thorough research, informed decision-making, and proactive risk management. By implementing the strategies and tools Artikeld here, individuals and businesses can navigate the complexities of international transactions with greater confidence and potentially reduce financial exposure to exchange rate volatility.