Remote work has exploded in popularity, and with it comes the need for streamlined financial management. This guide provides a detailed roadmap for securing a remote-friendly bank account, tailored to the specific needs of today’s digital workforce. From understanding the key characteristics of these accounts to navigating the opening process and maintaining security, we’ll equip you with the knowledge to make the best financial decisions for your remote lifestyle.

This comprehensive guide dives deep into the various aspects of remote-friendly banking. We explore the benefits, highlight crucial criteria for selection, and walk you through the account opening process, covering critical security considerations and practical applications. Whether you’re a freelancer, entrepreneur, or remote employee, understanding the nuances of remote-friendly banking is essential for efficient financial management.

Introduction to Remote-Friendly Banking

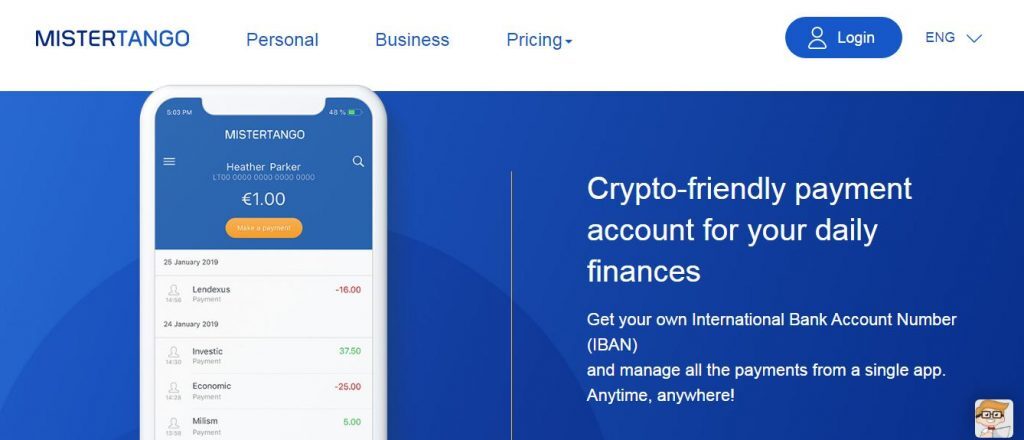

Remote-friendly banking accounts are designed to cater to the specific needs of individuals working remotely or as freelancers. These accounts offer a seamless digital experience, minimizing the need for in-person interactions and maximizing efficiency. They typically leverage advanced online and mobile platforms, streamlining tasks such as account management, bill payments, and money transfers.Remote-friendly accounts differ significantly from traditional brick-and-mortar bank accounts.

Traditional accounts often require in-person visits for certain transactions or have limited online functionality. In contrast, remote-friendly accounts are specifically built for digital interactions, offering comprehensive online and mobile access to manage finances.Remote workers and freelancers benefit significantly from these accounts. They eliminate the hassle of physically visiting a branch, allowing for greater flexibility and time management.

The streamlined online and mobile platforms facilitate quick access to account information, making it easier to track expenses, manage budgets, and receive timely notifications about transactions. This digital focus is particularly beneficial for those who operate on a flexible schedule or need to manage multiple accounts.Remote-friendly accounts prove invaluable in numerous situations. For example, a freelance writer working from a coffee shop might need to make a quick payment or check their account balance without leaving their current location.

Similarly, a remote software engineer working from home can effortlessly manage their finances through their mobile device. A freelancer working internationally can seamlessly conduct transactions across borders, eliminating potential delays or complexities associated with traditional banking methods.

Comparison of Remote-Friendly Bank Account Types

Different types of remote-friendly bank accounts cater to varying needs and preferences. These accounts vary in their level of online and mobile integration.

| Account Type | Key Characteristics | Benefits for Remote Workers |

|---|---|---|

| Online-Only | Primarily accessible through a dedicated website, often with limited or no physical branch presence. | Offers complete digital control over finances, suitable for those who prioritize online accessibility. |

| Mobile-First | Emphasizes a highly intuitive mobile app experience, allowing users to perform most transactions directly from their smartphone. | Provides maximum flexibility and convenience, especially for those working on the go. |

| Hybrid | Combines elements of both online-only and mobile-first accounts, offering a blend of web and app access. | Provides options to suit different preferences, allowing users to choose the platform that best fits their needs. |

Identifying Suitable Bank Accounts

Selecting a remote-friendly bank account is crucial for seamless financial management when working from anywhere. This process involves careful consideration of various factors beyond simply having online access. A truly remote-friendly bank offers more than just basic online banking; it provides a comprehensive digital experience that caters to the needs of modern remote workers.

Key Criteria for Selection

Remote-friendly banks excel in providing a range of digital services that facilitate easy account management, transactions, and customer support. A thorough evaluation of these criteria ensures the selected bank aligns with your specific needs. These criteria include a robust online platform, mobile accessibility, convenient transaction options, and reliable customer service.

Evaluating Online and Mobile Banking Services

A superior online banking platform should feature intuitive navigation, clear account summaries, and secure transaction processing. Mobile banking applications should mirror the online platform’s functionality and offer real-time account updates, allowing for efficient financial monitoring regardless of location. Look for functionalities like mobile check deposit, bill pay, and secure online transfer options. A key consideration is the responsiveness and usability of the mobile app across different devices and operating systems.

Assessing Fees and Transaction Limits

Transaction fees and limits are essential considerations when choosing a remote-friendly bank. Banks often impose fees for international transfers, ATM withdrawals, or excessive transactions. Understanding these fees and their application is critical to avoid unexpected charges. Likewise, consider transaction limits to ensure that your financial activities can be accommodated without restrictions. Thorough review of the bank’s fee schedule and transaction limits is vital.

Evaluating Customer Support Options

Excellent customer support is paramount for a smooth remote banking experience. Look for banks that offer diverse support channels, including online chat, email, phone support, and social media interaction. The availability of 24/7 support, particularly during non-business hours, is essential for addressing urgent financial needs. Responsiveness and the ability to resolve issues efficiently are also critical factors.

This ensures prompt assistance when needed, especially for remote workers.

Key Features of a Remote-Friendly Bank Account

The table below highlights essential features to consider when selecting a remote-friendly bank account. The features listed provide a practical framework for evaluating banks, allowing you to make an informed decision.

| Feature | Description |

|---|---|

| Online Banking Platform | Intuitive navigation, clear account summaries, secure transaction processing, mobile compatibility. |

| Mobile Banking App | Real-time account updates, mobile check deposit, bill pay, secure transfers, accessible across devices. |

| Transaction Fees and Limits | Clear understanding of international transfer fees, ATM withdrawal fees, and transaction limits. |

| Customer Support | Diverse support channels (online chat, email, phone), 24/7 availability, efficient issue resolution. |

| Security Measures | Robust security protocols, regular security updates, multi-factor authentication options. |

Opening a Remote-Friendly Account

Opening a remote-friendly bank account offers significant advantages for modern, digitally-focused individuals. It streamlines financial management, allowing for transactions and account maintenance without the need for in-person visits. This process is often faster and more convenient than traditional methods.Successfully opening a remote account requires a secure and efficient approach. This section will Artikel the steps involved, from verifying your identity to setting up essential services like direct deposit and bill pay.

Understanding these procedures ensures a smooth and trouble-free experience.

Remote Identity Verification

Remote identity verification is a crucial aspect of opening a remote-friendly bank account. Banks employ various methods to ensure the accuracy and legitimacy of the account holder’s information. These measures protect the bank and the account holder from fraudulent activities.

- Photo Identification: Many banks require uploading a copy of a government-issued photo ID, such as a driver’s license or passport. This document serves as a primary means of verifying your identity. The image should be clear and show all relevant details, including the name, date of birth, and photo. Ensure the image is of sufficient resolution to be accurately processed by the bank’s system.

- Address Verification: The bank will typically request proof of your address. This could involve providing a utility bill, a recent lease agreement, or a similar document that shows your current address. The document should be recent and clearly indicate your full name and address. It’s essential to ensure the address information matches your identification document accurately.

- Additional Documentation: Some banks might request additional documents, such as proof of employment or income, to further validate your identity and financial standing. These requirements can vary based on the specific bank and your circumstances.

Password Security and Authentication

Robust password security and multi-factor authentication are essential for protecting your account from unauthorized access. A strong password strategy is a critical first step.

- Strong Passwords: Create passwords that are difficult to guess. Use a combination of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like birthdays, names, or common words. A password manager can assist in creating and storing complex passwords securely.

- Multi-Factor Authentication (MFA): Enabling MFA adds an extra layer of security to your account. This method requires more than just a username and password to log in. Common MFA methods include receiving a code via text message or email, or using an authenticator app. Activating MFA is strongly recommended for enhanced account protection.

Direct Deposit and Bill Pay Setup

Setting up direct deposit and bill pay is often a straightforward process within a remote-friendly banking platform. These services enhance convenience and efficiency in managing your finances.

- Direct Deposit: To set up direct deposit, you will typically provide your employer’s bank account details or complete the necessary forms. Ensure that the details provided match the bank account information exactly to avoid any errors in the direct deposit process. Direct deposit is a secure and reliable method of receiving your paychecks.

- Bill Pay: Enabling bill pay allows you to schedule payments for recurring bills automatically. You will need to input the recipient’s information and the amount. Verify the information carefully to avoid any issues with incorrect payments.

Step-by-Step Account Opening Guide

The following is a general guide; specific steps may vary by bank.

- Access the bank’s website or mobile app: Locate the account opening section. Click on the “Open Account” button.

- Provide personal information: Fill out the form with accurate personal details, including your name, address, date of birth, and social security number.

- Upload required documents: Select and upload the required documents for identity verification (photo ID, address verification).

- Choose your account type: Select the account type that suits your needs.

- Create a secure password: Choose a strong password and enable multi-factor authentication.

- Set up direct deposit and bill pay (optional): If desired, follow the prompts to set up these services.

- Review and submit: Carefully review all entered information and submit your application.

Managing Your Remote Account

Effective management of your remote bank account is crucial for maintaining financial well-being and avoiding potential issues. This involves utilizing online and mobile banking tools efficiently, meticulously tracking transactions, and implementing a sound budgeting strategy. By mastering these techniques, you can ensure your finances remain organized and under control.Maintaining a healthy financial picture requires consistent monitoring and proactive management of your funds.

Online and mobile banking platforms offer powerful tools to achieve this. Understanding how to leverage these tools can significantly reduce the risk of overdraft fees and other financial pitfalls.

Tracking Transactions and Budgeting

Thorough transaction tracking is fundamental for understanding your spending habits and ensuring financial accountability. By diligently recording every transaction, you gain a comprehensive view of your income and expenses, enabling informed budgeting decisions. Regularly reviewing your transactions helps you identify potential areas for saving or adjustments in your spending patterns. This process can be further enhanced by using budgeting tools integrated into your banking app or separate budgeting software.

Strategies for Using Mobile Apps

Mobile banking apps provide convenient access to your account information anytime, anywhere. Utilizing these apps allows for immediate transaction monitoring, enabling you to promptly address any unusual activity. By setting up alerts for low balances or specific transactions, you can proactively manage your funds and avoid overdrafts. Leveraging push notifications and in-app alerts for important transactions further enhances this proactive approach.

Using Online Tools to Avoid Overdraft Fees

Online banking platforms often provide tools to help you anticipate and avoid overdraft fees. These tools allow you to set up alerts for approaching account balances, helping you plan ahead and avoid unexpected charges. By monitoring your available funds closely, you can make necessary adjustments to your spending to stay within your budget and avoid fees. Some online platforms even offer overdraft protection options, which you can consider based on your financial needs.

Common Mobile Banking Features for Remote Account Management

| Feature | Description | Example |

|---|---|---|

| Transaction History | Allows viewing all past transactions with details like date, amount, and description. | View all transactions from the past month to identify spending patterns. |

| Balance Inquiry | Provides instant access to your account balance. | Check your balance before making a purchase to avoid overspending. |

| Bill Payments | Facilitates automatic or scheduled payments for recurring bills. | Set up automatic payments for rent, utilities, or subscriptions. |

| Transfer Funds | Enables secure and convenient transfers between your accounts. | Transfer funds between your savings and checking accounts. |

| Alerts and Notifications | Allows for customized alerts on account activity (e.g., low balance, transaction limits). | Set up an alert when your balance drops below $50. |

| Mobile Check Deposit | Enables depositing checks using your mobile device’s camera. | Deposit a paycheck or other checks directly through your mobile banking app. |

Security Considerations for Remote Accounts

Remote banking offers convenience and flexibility, but it also introduces new security challenges. Protecting your financial information is paramount when accessing accounts online, especially given the rise in sophisticated cyber threats. Understanding the risks and implementing proactive security measures is crucial for maintaining peace of mind and safeguarding your financial well-being.

Importance of Cybersecurity for Remote Banking

Robust cybersecurity measures are essential for protecting sensitive financial data in the remote banking environment. A breach of your account could lead to significant financial losses, identity theft, and reputational damage. The digital landscape is constantly evolving, and cybercriminals are always developing new tactics to exploit vulnerabilities. This necessitates a vigilant and proactive approach to online security.

Common Online Banking Scams

Online banking scams are unfortunately prevalent, targeting unsuspecting individuals. Recognizing the different types of scams and knowing how to avoid them is critical. These fraudulent schemes often employ deceptive tactics to trick users into revealing their personal information or transferring funds.

- Phishing: Phishing involves deceptive emails, text messages, or websites designed to trick individuals into revealing sensitive information, such as usernames, passwords, and credit card details. Criminals often impersonate legitimate institutions or individuals to gain access to accounts.

- Malware Attacks: Malware, such as viruses or spyware, can infiltrate your computer or mobile device and steal your personal data. This data can then be used for fraudulent activities.

- Social Engineering: Social engineering exploits human psychology to manipulate individuals into divulging confidential information. This often involves creating a sense of urgency or trust.

- Fake Websites: Criminals create fraudulent websites that mimic legitimate online banking portals. These websites can appear almost identical to the real thing, making it difficult to distinguish between them.

Protecting Sensitive Financial Information

Protecting sensitive financial information is a crucial aspect of online safety. Implementing strong security practices and being aware of potential threats are paramount. This includes using strong passwords, enabling two-factor authentication, and being wary of suspicious emails or websites.

- Strong Passwords: Use unique, complex passwords for each online account. Avoid easily guessable passwords, such as birthdates or names. Consider using a password manager to generate and store strong passwords securely.

- Two-Factor Authentication (2FA): Enable 2FA whenever possible. This adds an extra layer of security, requiring a second verification method, such as a code sent to your phone, to access your account.

- Regular Software Updates: Keep your operating system, antivirus software, and other applications up-to-date. This helps to patch security vulnerabilities and protect against known threats.

Examples of Phishing Scams Targeting Remote Workers

Phishing scams are particularly prevalent in the remote work environment. Cybercriminals exploit the increased reliance on online communication and remote access to target individuals. Examples include:

- Fake Email Notifications: Criminals might send emails that appear to be from the bank, informing the user of a suspicious activity or a need to update their account information. These emails contain malicious links that redirect users to fraudulent websites.

- Spoofed Customer Support Contacts: Fake customer support emails or phone calls might attempt to trick remote workers into revealing their credentials or transferring funds by posing as legitimate support personnel.

- Malicious Links in Instant Messages: Criminals can send messages containing malicious links, disguised as legitimate updates or communications, to trick remote workers into accessing fraudulent websites.

Guide to Safeguarding Your Remote Banking Information

Implementing a comprehensive approach to security is essential. Here’s a guide to safeguarding your remote banking information:

- Verify Website Authenticity: Carefully review the website address (URL) before entering any sensitive information. Look for the “https” prefix and a secure lock icon in the address bar.

- Report Suspicious Emails/Texts: Report any suspicious emails or text messages to the appropriate authorities, or to your bank directly. Don’t click on links or reply to suspicious messages.

- Use Strong Passwords and 2FA: Create strong, unique passwords and enable 2FA on all remote banking accounts.

- Stay Informed About Security Threats: Keep abreast of current cyber threats and scams. Regularly update your knowledge of security best practices.

Alternatives and Comparisons

Choosing the right remote-friendly bank account is crucial for seamless financial management when working remotely. This section delves into the key differences between remote-friendly and traditional bank accounts, offering a comparative analysis of various features and services, and outlining factors to consider when making your selection. Understanding the nuances of different banking solutions will empower you to select the best fit for your remote work lifestyle.A remote-friendly bank account is designed with the needs of digital nomads and remote workers in mind.

Traditional accounts, while functional, often lack the specific features and accessibility crucial for those working outside a fixed location. A comparative overview of features and services is vital for informed decision-making.

Comparison of Remote-Friendly and Traditional Bank Accounts

Traditional bank accounts generally offer basic services, such as deposit and withdrawal options, often with limited online access and potentially inconvenient branch locations. Remote-friendly accounts, conversely, prioritize digital accessibility, providing features like mobile banking, online account management, and 24/7 customer support, crucial for remote workers.

Features Offered by Different Banks

Various banks provide different levels of remote banking features. Some offer comprehensive digital platforms with features such as mobile check deposit, international money transfers, and tailored budgeting tools. Others might emphasize security measures and fraud protection. Investigating the specific offerings of different banks is essential. Features like bill pay, budgeting tools, and international transaction capabilities are examples of important distinctions to consider.

Factors Influencing the Best Choice for a Remote Worker

Several factors influence the ideal remote-friendly bank account. Consider your spending habits, transaction frequency, international transaction needs, and preferred method of communication. For example, a freelancer frequently transferring money internationally might require a bank with robust international transaction capabilities. Likewise, a remote worker primarily managing local expenses might prioritize a bank with competitive local transaction fees. Assessing your specific needs will aid in choosing the most suitable account.

Comparison Table of Remote-Friendly Bank Accounts

| Bank | Monthly Fee | International Transfer Fees | Mobile App Features | Security Features |

|---|---|---|---|---|

| Bank A | $5 | $25 per transaction | Mobile check deposit, 24/7 customer support, budgeting tools | Two-factor authentication, fraud alerts |

| Bank B | Free | $10 per transaction | Mobile check deposit, real-time account updates, international money transfer | Biometric login, enhanced security protocols |

| Bank C | $10 | Free | Mobile check deposit, bill pay, budgeting tools | Two-factor authentication, transaction monitoring |

This table presents a simplified comparison. Actual fees and features may vary. It is crucial to check the specific terms and conditions on the bank’s website for detailed information.

Pros and Cons of Different Remote Banking Solutions

Remote banking solutions offer various advantages, including convenience and accessibility. However, they also present potential drawbacks, such as security concerns and limited in-person interaction. A detailed analysis of the specific advantages and disadvantages of different solutions is vital.

A robust online banking platform offers convenience and accessibility, but the reliance on digital interactions may not be suitable for all users.

For example, some users may prefer the personal touch of in-person interactions with a financial advisor. The advantages and disadvantages should be considered in relation to individual needs.

Remote-Friendly Account Use Cases

Remote-friendly bank accounts offer significant advantages for individuals working remotely, facilitating various transactions and streamlining financial management across geographical boundaries. These accounts are designed with the needs of the modern, mobile workforce in mind, providing enhanced features for international transfers, global payments, and business transactions.Remote-friendly accounts are tailored to the unique demands of the globalized workforce. They simplify financial processes for remote workers by offering user-friendly interfaces, readily accessible tools, and security measures.

This simplifies the management of international payments, crucial for freelancers and businesses operating globally.

International Transaction Management

Remote work often necessitates handling international transactions. Remote-friendly accounts provide enhanced tools and features for managing these cross-border payments, including multiple currency support, reduced fees for international transfers, and transparent transaction tracking. This is vital for freelancers working with clients globally or for remote employees managing payments to international suppliers.

- Currency Conversion and Exchange Rates: Many remote-friendly accounts offer real-time currency conversion, allowing users to see the exact amount in their local currency before making an international transfer. This feature ensures that users understand the true cost of international transactions and avoids hidden fees.

- Reduced Transaction Fees: Some remote-friendly accounts provide lower fees for international transfers compared to traditional bank accounts. This can significantly reduce the financial burden of cross-border payments, especially for frequent transactions.

- Transparent Transaction Tracking: Detailed transaction history with clear information on fees, exchange rates, and transaction times allows for efficient monitoring and management of international financial flows.

Global Payments for Freelancers

Freelancers often receive payments from clients located in different countries. Remote-friendly accounts simplify this process, facilitating secure and efficient international money transfers.

- Faster Payment Processing: Remote-friendly accounts often utilize secure and efficient international payment networks, leading to faster processing times for payments received from clients in different time zones.

- Multiple Payment Options: The ability to receive payments through various methods, such as bank transfers, wire transfers, and digital payment platforms, is a key advantage for freelancers.

- Simplified Tax Reporting: The clear and detailed transaction records provided by remote-friendly accounts aid freelancers in complying with international tax regulations and reporting requirements.

Remote Business Transactions

Remote businesses, particularly startups and small enterprises, benefit significantly from remote-friendly accounts for efficient and secure transactions.

- Multiple Account Access: Remote-friendly accounts often offer multiple account access features, enabling authorized employees to manage finances from anywhere in the world. This feature is crucial for companies with remote teams or dispersed locations.

- International Payment Processing: Streamlined processing of payments from and to clients globally allows businesses to expand their operations without limitations.

- Secure Payment Infrastructure: These accounts prioritize security and fraud prevention, protecting businesses from potential financial risks associated with international transactions.

Real-World Examples

A graphic designer working remotely for clients in the US and Europe can easily manage international payments through a remote-friendly account. The account’s features allow her to track exchange rates, reduce transaction fees, and receive payments in her local currency. A freelance software developer working with clients globally can utilize the account’s multiple payment options and transparent transaction history to efficiently manage income from various sources and maintain accurate financial records.

Final Review

In conclusion, establishing a remote-friendly bank account is a crucial step for navigating the modern, globalized workplace. This guide has provided a thorough overview of the process, from understanding the basics to managing your account securely. By following these steps and considering the factors discussed, you’ll be well-equipped to optimize your financial management in your remote work environment.