Navigating international transactions can be complex, requiring a deep understanding of diverse payment methods and meticulous attention to detail. This guide provides a comprehensive approach to handling international invoicing and ensuring timely payments, from setting up the process to managing currency risks and resolving potential disputes. By following these steps, businesses can streamline their international operations and foster successful collaborations with clients across borders.

This guide will explore the nuances of various international payment systems, offering detailed explanations of wire transfers, SWIFT, letters of credit, and online payment gateways. We’ll examine the pros and cons of each method, helping you select the optimal approach for your specific needs. Further, the document will delve into crafting professional international invoices, including essential elements and crucial considerations for clear communication.

Understanding International Payment Systems

![10 Best Online Invoicing Software to Help You Get Paid Faster [2021] 10 Best Online Invoicing Software to Help You Get Paid Faster [2021]](https://tipstar.web.id/wp-content/uploads/2025/09/Invoicing_showcase_opt.png)

International invoicing necessitates a thorough understanding of diverse payment methods. Navigating these systems is crucial for efficient transactions and minimizing financial risks. This section details various options, highlighting their strengths and weaknesses to aid businesses in making informed decisions.International transactions often involve complexities that domestic payments do not. Understanding the nuances of international payment systems, including the varying speeds, costs, and security measures, is essential for successful international invoicing.

International Payment Methods

Different international payment methods cater to varying needs and priorities. Understanding the advantages and disadvantages of each is key to selecting the optimal method for a specific transaction.

- Wire Transfers: Wire transfers, also known as bank transfers, are a traditional method for sending money internationally. They involve transferring funds electronically between bank accounts. A significant advantage is the widespread availability of this method. However, wire transfers can be time-consuming and costly, particularly if international banking fees are involved. Security is generally good, but the process can be vulnerable to human error, such as incorrect account details.

- SWIFT (Society for Worldwide Interbank Financial Telecommunication): SWIFT is a global network that facilitates secure and standardized communication between financial institutions. Using SWIFT for wire transfers provides a standardized way to send funds internationally, reducing the risk of errors. However, SWIFT transactions are not always the cheapest option and may have higher fees compared to other methods, depending on the participating banks.

- Letters of Credit (LCs): Letters of credit are issued by a bank to guarantee payment to a seller upon fulfillment of specific conditions. This method provides strong buyer protection and enhances trust in international trade. However, letters of credit can be more complex and time-consuming to process, involving multiple parties and documentation. Costs associated with issuing and managing an LC can be substantial, particularly for small-to-medium-sized businesses.

- Online Payment Gateways: Online payment gateways, such as PayPal, Stripe, and others, offer a user-friendly way to receive international payments. Their ease of use and broad acceptance make them attractive for businesses dealing with customers globally. However, the security of these transactions relies on the chosen platform’s security protocols. Transaction fees associated with online payment gateways can vary significantly, often impacting the final cost to the seller.

Comparison of Payment Methods

A comprehensive comparison of payment methods is presented below, highlighting their relative speed, cost, and security.

| Method | Speed | Cost | Security |

|---|---|---|---|

| Wire Transfers | Moderate to Slow | Moderate to High | Good |

| SWIFT | Moderate | Moderate | High |

| Letters of Credit | Slow | High | Very High |

| Online Payment Gateways | Fast | Moderate to High | Good (dependent on platform) |

Currency Exchange Rates

Currency exchange rates play a pivotal role in international invoicing. Fluctuations in exchange rates can significantly impact the final amount received.

Understanding and managing currency exchange risks is crucial for international businesses.

For instance, if the exchange rate for the recipient’s currency weakens against the invoicing currency, the final payment amount in the invoicing currency will be reduced. Conversely, a strengthening of the recipient’s currency will increase the payment amount. Businesses should factor in these fluctuations when creating invoices and managing international transactions. Using a forward contract or hedging strategy can mitigate these risks, but these tools can also add complexity to the process.

Businesses should carefully consider these options based on their specific circumstances and transaction volume.

Setting Up International Invoicing Processes

Establishing a robust international invoicing process is crucial for smooth transactions and timely payments. A well-defined system ensures clarity for both your company and international clients, minimizing misunderstandings and potential delays. This process should be tailored to the specific needs of your international clientele and the regulations of the involved countries.International transactions often involve complexities beyond domestic invoicing.

These complexities include differing payment preferences, currency exchange rate fluctuations, and potential variations in legal and accounting requirements. Therefore, careful planning and adherence to best practices are essential for success.

Designing Professional International Invoices

A professional invoice is more than just a document; it’s a crucial communication tool that sets the tone for the entire transaction. Clear and accurate invoices reduce the risk of disputes and promote a positive business relationship with international clients. International invoices should be easily understandable, regardless of the recipient’s location or language.

Invoice Format Examples

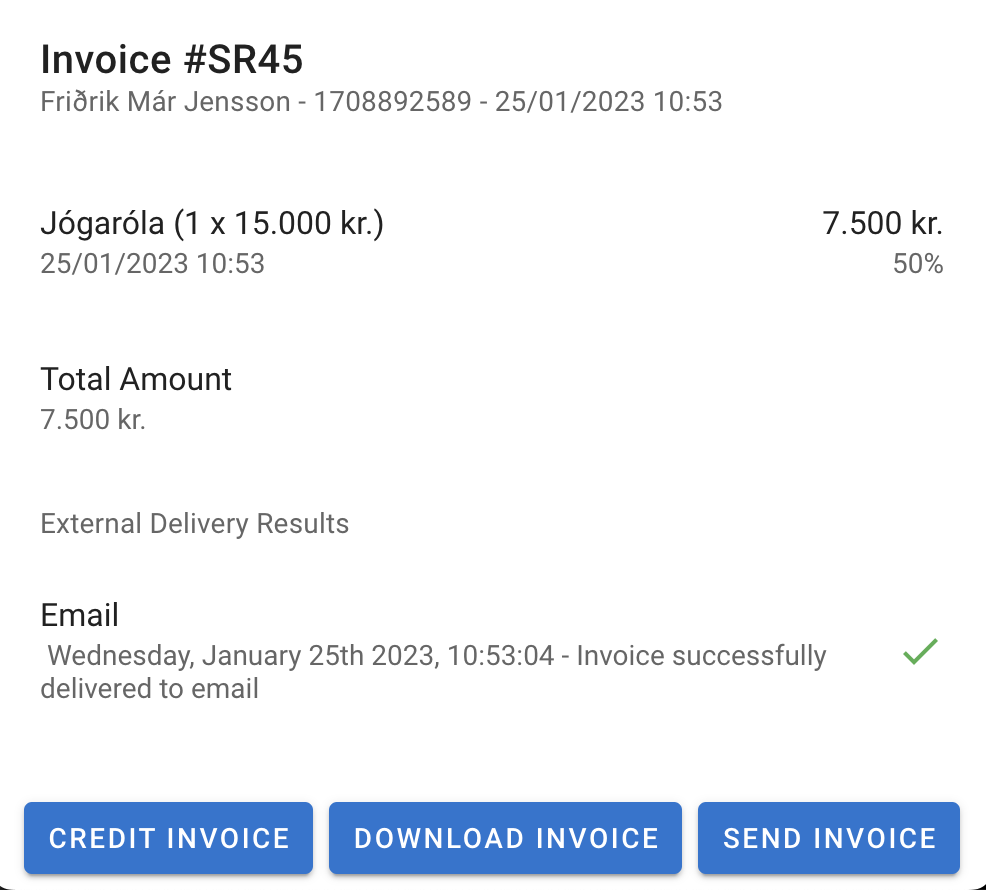

Various invoice formats are suitable for international transactions. These formats often use standardized templates to ensure clarity and consistency.

- Standard Invoice Format: This format typically includes elements like invoice number, invoice date, billing address, description of goods or services, quantity, unit price, total amount, payment terms, and due date. Using a consistent format, even for international clients, promotes ease of understanding and processing.

- Electronic Invoices: Electronic invoices are increasingly common in international trade. They offer efficiency, reduced paper usage, and often faster processing. They’re often sent through email or dedicated electronic invoicing platforms.

- Multilingual Invoices: For invoices sent to clients in different countries, including the relevant language(s) in the invoice is essential. This ensures the invoice is readily understood by the recipient. Multilingual support is especially important when the client’s native language differs from yours.

Essential Information on International Invoices

A well-structured invoice contains all the necessary information to facilitate the transaction and payment.

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| 1 | Software License | 1 | $100.00 | $100.00 |

| 2 | Technical Support (3 months) | 1 | $50.00 | $50.00 |

| 3 | International Shipping | 1 | $25.00 | $25.00 |

| Total | $175.00 |

The table above provides a concise example of the necessary elements. A complete international invoice should include:

- Clear and Unambiguous Language: Avoid jargon or ambiguous terms. Use precise and universally understood terminology to prevent misunderstandings.

- Currency: Specify the currency used for pricing, and convert amounts to the client’s currency when necessary. Clearly indicating the currency is crucial to avoid errors in calculations and misunderstandings.

- Payment Terms: Explicitly state the payment terms, including the due date and acceptable payment methods. This should include details about any applicable fees or penalties for late payments.

- Contact Information: Provide both your company’s and the client’s contact information. This facilitates communication and dispute resolution.

- Invoice Number: Assign a unique invoice number for easy tracking and reference.

- Detailed Description: Provide a detailed description of the goods or services, including the specific services rendered or products provided.

Managing Currency Risks

International transactions inherently involve the risk of fluctuations in exchange rates. These fluctuations can significantly impact the profitability of your business, making it crucial to understand and manage these risks effectively. Properly accounting for currency exchange rate variations is essential for accurate invoicing and maintaining financial stability.Effective management of currency risks in international invoicing involves proactive strategies that mitigate potential losses and ensure fair pricing for both parties.

This includes a deep understanding of hedging techniques and how they can protect your business against unfavorable exchange rate movements. Careful consideration of these factors helps in building a more robust and resilient international invoicing system.

Methods to Mitigate Currency Risk

Understanding the various approaches to mitigate currency risk is paramount for successful international transactions. Different strategies provide varying levels of protection against exchange rate fluctuations, each with its own implications and costs.

- Forward Contracts: A forward contract allows you to lock in an exchange rate for a future transaction date. This provides certainty about the cost of converting one currency to another. The contract is agreed upon in advance and specifies the exchange rate, the amount of currency to be exchanged, and the date of the transaction. This eliminates the risk of unfavorable exchange rate movements on the agreed-upon date.

- Currency Options: Similar to forward contracts, currency options give you the right, but not the obligation, to exchange a specific amount of currency at a predetermined rate on or before a certain date. Options offer flexibility but come with a premium cost. This is suitable when you want to be prepared for fluctuations but don’t want to lock in a specific exchange rate.

- Hedging with Currency Futures: Currency futures contracts are standardized agreements to buy or sell a specific currency at a predetermined future date. These contracts provide a means to hedge against currency risk, allowing you to offset potential losses from unfavorable exchange rate movements. The futures market often involves more significant leverage than other methods.

- Natural Hedging: Natural hedging occurs when your company has both inbound and outbound transactions in the same currency. If you have a balance of transactions in both directions, the fluctuations in the exchange rate may offset each other, reducing the overall risk.

Hedging and International Invoicing

Hedging plays a critical role in international invoicing by allowing businesses to reduce the uncertainty associated with currency fluctuations. By employing hedging strategies, businesses can ensure they receive a predictable amount in their domestic currency, irrespective of exchange rate fluctuations on the day of payment.

Hedging, in the context of international invoicing, is a risk management technique used to protect against losses arising from adverse currency movements.

This predictability is crucial for accurate financial planning and budgeting.

Example of Currency Fluctuation Impact

Consider a US-based company exporting goods to a company in the Eurozone. Suppose the company invoices €100,000 on January 1st, 2024, with payment due in three months.

| Date | Exchange Rate (USD/EUR) | Invoice Amount (USD) |

|---|---|---|

| January 1, 2024 | 1.08 | 108,000 |

| April 1, 2024 | 1.12 | 112,000 |

The company originally expected to receive $108,000. However, if the exchange rate moves to 1.12 USD/EUR by the payment date, the company receives $112,000. This represents a favorable fluctuation. Conversely, if the exchange rate had decreased, the company would receive a smaller amount in USD.

Incorporating Exchange Rate Fluctuations into Invoicing

Several approaches can be used to account for exchange rate fluctuations when invoicing internationally. One method is to specify the invoice currency, and then convert the payment amount to the customer’s currency based on the exchange rate on the payment date. This approach allows both parties to be clear about the exchange rate risk.

- Invoice Currency Selection: Choosing a currency for the invoice can influence the level of risk exposure. Invoicing in a stable currency, such as the US dollar or Euro, can reduce the impact of exchange rate fluctuations. Invoicing in the buyer’s currency can mitigate the risk for the seller, but the buyer may need to pay a premium.

- Using a Forward Contract: Utilizing forward contracts to lock in an exchange rate at the time of invoicing provides a certain level of protection from unfavorable fluctuations. This ensures a fixed amount in the local currency for the seller.

- Currency Adjustment Clause: Including a currency adjustment clause in the contract can address exchange rate fluctuations. This clause specifies how the exchange rate will be calculated on the payment date.

Choosing the Right Payment Terms

Establishing appropriate payment terms is crucial for smooth international transactions and building trust with clients. Effective negotiation of these terms ensures timely payment and minimizes financial risks for both parties. Understanding the nuances of different payment methods is essential to navigating the complexities of international commerce.

Common International Payment Terms

Various payment terms are employed in international trade, each with its own set of advantages and disadvantages. Selecting the right term depends on factors like the client’s financial standing, your company’s risk tolerance, and the specifics of the transaction.

- Net 30: Payment is due 30 days after the invoice date. This is a common and widely accepted term, particularly for established clients. It allows for a reasonable timeframe for processing payments while providing a clear timeframe for payment.

- Net 60: Payment is due 60 days after the invoice date. This offers a slightly longer timeframe for payment, which might be preferable for clients with slower internal processing. However, it also carries a higher risk of delayed payments.

- 50% Deposit: A 50% deposit is often required upfront before the goods or services are delivered. This term mitigates risk by securing a portion of the payment and provides a buffer for unexpected issues. It’s particularly useful when dealing with clients with less established financial histories.

- Letter of Credit (LC): A document issued by a bank guaranteeing payment to the seller upon fulfillment of specific conditions. This is a highly secure method, often used in large transactions or with less established clients. The bank acts as an intermediary, reducing the risk for the seller. However, LC processing often incurs fees and can be a more complex process.

- Cash in Advance: Full payment is required before the goods or services are delivered. This term provides the highest security for the seller but may deter some clients, especially if the transaction involves a significant sum.

Negotiating Payment Terms with International Clients

Successful negotiation requires understanding the client’s business practices and financial situation. Clear communication is key, and using a formal tone while maintaining a friendly approach is vital.

- Research the client: Thoroughly investigate the client’s financial history and reputation to assess their creditworthiness. This will inform your negotiation strategy.

- Present options: Clearly Artikel the payment terms you’re offering and the rationale behind them. This helps the client understand the terms and allows for a more informed decision.

- Be flexible: Be willing to compromise and consider the client’s needs, but prioritize your company’s financial interests. This can involve adjusting the payment timeframe or offering alternative payment options.

- Document everything: Formalize all agreements in writing to avoid future disputes. This includes clearly defined payment schedules, deadlines, and any other relevant conditions.

Comparing Different Payment Terms

The table below provides a comparison of common payment terms, highlighting their advantages and disadvantages.

| Term | Description | Pros | Cons |

|---|---|---|---|

| Net 30 | Payment due 30 days after invoice date | Common, widely accepted, encourages timely payment | Higher risk of delayed payments if client is not reliable |

| Net 60 | Payment due 60 days after invoice date | Provides a longer payment timeframe | Increased risk of non-payment, potentially more bureaucratic process |

| 50% Deposit | 50% payment upfront before delivery | Reduces risk for seller, shows client commitment | May deter some clients, can create a longer sales cycle |

| Letter of Credit | Bank guarantees payment upon fulfillment of conditions | High security, reduces risk for seller | Complex process, incurs fees, requires bank involvement |

| Cash in Advance | Full payment required before delivery | Highest security for seller | May deter clients, especially for large transactions |

Risks and Benefits of Different Payment Terms

Careful consideration of the risks and benefits associated with each payment term is crucial. Understanding these nuances allows you to make informed decisions that protect your company’s interests.

“Choosing the right payment terms is a crucial element in the success of any international transaction.”

Documenting and Tracking Payments

Thorough documentation and meticulous tracking of international payments are crucial for maintaining accurate financial records and ensuring smooth transactions. This is especially important when navigating the complexities of different currencies, payment methods, and international banking regulations. Effective tracking allows businesses to identify potential issues early on, manage risks, and ultimately facilitate successful international trade.Accurate record-keeping for international transactions is paramount for several reasons.

Firstly, it provides a clear audit trail, crucial for resolving disputes and demonstrating compliance with regulations. Secondly, it facilitates informed financial decision-making, allowing businesses to assess the profitability of international ventures and identify areas for improvement. Finally, detailed records enable businesses to track currency fluctuations and adjust strategies accordingly, minimizing potential losses.

Payment Tracking Method

A robust system for tracking international payments should encompass details like invoice number, payment date, amount, currency, payment method, recipient’s bank details, and transaction reference numbers. Employing a centralized system for recording these details ensures consistent data entry and reduces the risk of errors.

Importance of Accurate Record-Keeping

Accurate record-keeping is vital for international transactions. It enables businesses to reconcile payments with invoices, identify discrepancies promptly, and manage potential financial risks. Maintaining detailed records ensures a smooth audit process and provides a comprehensive overview of the financial health of international operations. Comprehensive documentation is essential for resolving disputes effectively, demonstrating compliance with regulations, and providing accurate financial reporting.

Accounting Software for International Invoicing and Payments

Accounting software tailored for international transactions can significantly streamline the management of invoices and payments. These specialized programs often facilitate multi-currency support, automatic exchange rate updates, and features for tracking international payments. They can automatically generate reports and track payments against invoices, saving significant time and resources. Utilizing accounting software can reduce manual errors and improve the overall efficiency of international financial operations.

Document Formats for Recording International Payments

A standardized format for recording international payments can help maintain consistency and accuracy. Examples include:

- Payment Register: This document typically includes columns for invoice number, date, amount, currency, payment method, recipient details, transaction reference number, and any relevant notes. This register offers a comprehensive overview of all payments processed.

- Payment Confirmation Email/Letter: A formal email or letter confirming the receipt of payment is essential, particularly for international transactions. This confirmation should include the invoice number, payment amount, currency, and date of payment. It provides crucial proof of payment for both parties involved.

- Bank Statements: Bank statements for the account used for international transactions are critical for verifying payment details. These statements should be reviewed periodically to ensure accuracy and identify any discrepancies.

Implementing these methods can significantly enhance the accuracy and efficiency of international payment processing, leading to smoother transactions and reduced financial risks.

Legal and Regulatory Considerations

Navigating the intricacies of international invoicing requires a deep understanding of the legal and regulatory frameworks governing both the seller’s and buyer’s jurisdictions. This encompasses a wide range of considerations, from tax implications and payment processing regulations to the specific laws surrounding documentation and dispute resolution. Failure to comply with these regulations can lead to significant penalties and legal challenges.International transactions are subject to a complex web of laws and regulations.

Each country has its own unique set of rules for invoicing, tax reporting, and payment processing. Understanding these nuances is critical to ensuring smooth transactions and avoiding costly errors.

Tax Implications for International Transactions

International transactions often involve multiple tax jurisdictions. Understanding the tax implications for both the seller and the buyer is essential to ensure compliance. Sales taxes, value-added taxes (VAT), and other local levies can vary significantly across countries, requiring careful analysis.For example, if a US company sells goods to a company in the European Union, both the US and EU tax authorities may impose taxes on the transaction.

The seller must understand the VAT rules of the EU country where the buyer is located, and the buyer must understand the tax obligations in their home country.

Compliance with Local Regulations

Adherence to local regulations is paramount in international invoicing and payment processing. This includes adhering to specific rules and standards for documentation, payment methods, and dispute resolution. Failure to comply can lead to legal issues and financial penalties.

- Documentation Requirements: Different countries have specific requirements for invoices and supporting documents. These requirements can include detailed product descriptions, specific information about the parties involved, and unique documentation specific to each country. Understanding and adhering to these requirements ensures the transaction is legitimate and compliant.

- Payment Processing Regulations: Local regulations can restrict or mandate specific payment methods. For example, some countries may prefer wire transfers while others might favor certain online payment platforms. These regulations should be thoroughly researched to ensure compliance.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: These regulations, becoming increasingly important globally, mandate the verification of the identities of customers and the monitoring of transactions for suspicious activity. Failure to comply with AML/KYC regulations can result in severe penalties and legal action.

Examples of Relevant Regulations and Laws

The specifics of international invoicing laws vary greatly by country. Here are some examples:

| Country | Relevant Regulations |

|---|---|

| United States | US tax regulations (IRS), international trade regulations, and state-level regulations |

| European Union | VAT regulations, payment regulations (e.g., SEPA), and data protection laws (GDPR) |

| China | Chinese tax regulations, foreign exchange regulations, and anti-corruption laws |

A detailed analysis of the regulations specific to each transaction is essential to avoid potential pitfalls. Further research is recommended for each country involved to understand their particular requirements.

Building Trust with International Clients

Establishing trust is paramount when conducting business internationally. A strong foundation of trust fosters long-term relationships, reduces transaction risks, and encourages future collaborations. This trust is built not just on financial security but also on effective communication, transparency, and consistent professionalism. International clients, operating in different cultural contexts, often require a greater degree of demonstrable reliability than domestic clients.Building trust with international clients requires a proactive approach that goes beyond simply fulfilling contractual obligations.

It necessitates understanding cultural nuances, anticipating potential challenges, and demonstrating a genuine commitment to their satisfaction. This approach will ultimately enhance the client relationship and facilitate a smoother transaction process.

Strategies to Build Trust

Establishing trust with international clients involves proactive strategies. Building a strong reputation through positive interactions with previous clients, showcasing a deep understanding of the client’s needs, and demonstrating a commitment to delivering quality services are crucial steps.

- Demonstrate Expertise and Reliability: Provide clear and concise communication outlining your company’s expertise and experience in handling international transactions. Highlight any relevant certifications, licenses, or industry recognition. A portfolio of previous successful international projects, with positive testimonials, can significantly bolster trust.

- Cultural Sensitivity: Recognize and respect cultural differences in communication styles, business etiquette, and time zones. Researching the client’s culture and adapting your communication accordingly can demonstrate respect and build rapport.

- Transparency in Communication: Maintain open and honest communication throughout the entire process. Provide regular updates on project progress and address any concerns promptly and professionally. This includes clear communication regarding timelines, costs, and potential risks.

- Proactive Problem Solving: Anticipate potential issues and proactively develop solutions. A proactive approach to problem-solving demonstrates a commitment to the client’s success and builds trust by demonstrating preparedness.

Effective Communication with International Clients

Clear and consistent communication is essential to building trust and managing expectations.

- Using Appropriate Communication Channels: Employ the communication channels preferred by the client. Understanding their preferred methods of communication (email, phone, video conferencing) will streamline the process and ensure efficient exchange of information.

- Language Considerations: Use professional translators for all critical communications, particularly if there are language barriers. This ensures that the client fully understands the message and avoids misunderstandings.

- Respectful and Professional Tone: Maintain a respectful and professional tone in all communications. This is particularly important in international dealings where cultural differences can impact communication styles.

- Time Zone Awareness: Be mindful of time zone differences when scheduling meetings or responding to emails. Plan communication schedules accordingly to avoid delays or missed opportunities.

Ensuring Transparency in the Invoicing Process

Transparency in the invoicing process is crucial to maintaining trust. It allows clients to easily understand the charges and ensures a smooth payment process.

- Detailed and Accurate Invoices: Provide detailed invoices that clearly Artikel the services rendered, the agreed-upon pricing, and any applicable taxes. Ensure all figures are accurate and clearly stated. Detailed breakdowns for each line item help maintain clarity.

- Clear Payment Terms: Clearly Artikel the payment terms, including due dates, accepted payment methods, and any applicable penalties for late payment. This ensures a clear understanding of the expectations.

- Regular Payment Updates: Provide regular updates on the status of payments, addressing any queries promptly. This keeps clients informed and minimizes potential misunderstandings.

- Prompt Response to Inquiries: Respond promptly and professionally to all inquiries regarding invoices and payment terms. This demonstrates a commitment to resolving issues swiftly and efficiently.

Conclusion

In conclusion, this guide has equipped you with the knowledge and strategies to effectively handle international invoicing and secure payments. By understanding international payment systems, establishing sound invoicing processes, managing currency risks, selecting appropriate payment terms, and meticulously tracking payments, you can navigate the complexities of global commerce with confidence. This comprehensive approach ensures transparency, builds trust with international clients, and mitigates potential disputes, ultimately fostering smooth and successful international business ventures.